Key Differences Between Conventional and Reverse Mortgages

Key Differences Between Conventional and Reverse Mortgages

Every borrower has different goals in retirement. What makes logical sense for the type of loan one borrower chooses may make absolutely zero sense for another. Understanding the pros and cons of all options is critical in order to make the best possible decision to accomplish the goals.

Finance of America compares a Traditional Mortgage vs. a Reverse Mortgage

https://www.far.com/seniority/traditional-vs-reverse-mortgage-a-comparison/

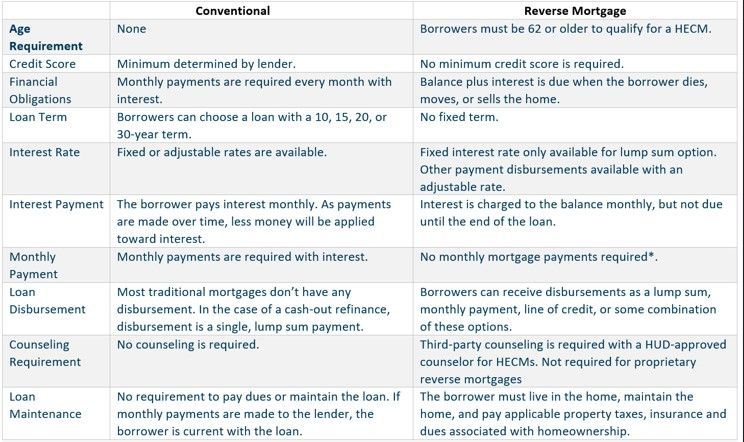

“Key Differences Between Conventional and Reverse Mortgages

Looking at features of the two loan types side by side can help borrowers understand how they differ from one another.

Reverse mortgage borrowers don’t make required monthly mortgage payments. However, they are still responsible for all property taxes, insurance, and other fees and dues associated with homeownership (i.e., HOA dues).”